Hotline

Tel:

+86-371-55976059

Address:

2403, Block B, Longzihu Zhengshang Xuefu Square, Zhengdong New District, Zhengzhou City

Hydrogen energy is gaining recognition in the industry as an "energy" due to its advantages such as cleanliness, zero emissions, and high heat. In the past few years, China has experienced a hydrogen energy boom, with dozens of local governments issuing plans to support the development of the hydrogen energy industry.

1、 The hydrogen energy industry welcomes new development opportunities

Against the backdrop of low-carbon development and energy transformation, the hydrogen energy industry in China has achieved a bottom-up development trend, with strong enthusiasm from the industry, local governments, and secondary markets. This is also the biggest factor driving the rapid development of the hydrogen energy industry. Especially with the active intervention of local governments, the competitive landscape of this industry in regional layout has been further established. On the other hand, hydrogen energy requires a large amount of financial subsidies from local governments in the short to medium term. Under the impact of the epidemic, the fiscal revenue of local governments has sharply decreased, especially in some economically disadvantaged provinces, which are not suitable for large-scale development of the hydrogen energy industry in the short term.

The reason why the new round of hydrogen energy has ushered in a development trend is a huge driving force from the application of hydrogen energy in the transportation field, especially the performance of fuel cells in the passenger car market, which has opened up space for the development of hydrogen energy applications. In the next 5-10 years, fuel cell vehicles will show a rapid growth trend globally.

2、 The problems that urgently need to be solved for the explosive growth of the hydrogen energy industry

One reason is that the cost of hydrogen is at a relatively high level. At present, the terminal hydrogen market price in Beijing and surrounding markets is 70 yuan/kg, and the price in the Yangtze River Delta and Pearl River Delta regions is 80-120 yuan/kg. Taking buses as an example, the hydrogen energy consumption per 100 kilometers is 8 kilograms, which is 560 yuan per 100 kilometers. Compared with gasoline and diesel vehicles, their competitiveness is seriously insufficient.

The second is whether the subsidy policy can be continued. At present, hydrogen fuel cell vehicles have relatively high financial subsidies. For general buses, if the journey reaches 20000 kilometers, they will receive a subsidy of about 1 million yuan. In the hydrogen refueling process, the current government subsidy for each kilogram of hydrogen is about 30 yuan. Whether the subsidy can continue in the future will directly affect the popularization and application of hydrogen powered vehicles.

The third is the layout and operation of infrastructure. Engineers from a Japanese fuel cell vehicle company have stated that it is easy to manufacture and produce a fuel cell vehicle, but the difficulty lies in how to lay out a comprehensive hydrogen refueling infrastructure network. The investment cost of a 35MP hydrogen refueling station currently ranges from 18 to 25 million yuan, with government subsidies ranging from 3 to 5 million yuan. Based on the current price of hydrogen, refueling about 400 hydrogen fuel vehicles per day can achieve a balance between revenue and expenditure. However, from the current vehicle situation, almost all hydrogen refueling stations in operation in China are in a loss making state. Although the government has adopted a bundled model of hydrogen refueling stations and gas stations in some areas to encourage investment in hydrogen refueling stations, it still cannot fundamentally solve the problem of difficult layout of hydrogen refueling stations.

If the cost of hydrogen and the layout of hydrogen refueling infrastructure are not resolved for a long time, the development of the hydrogen energy industry will inevitably be seriously hindered. Therefore, it is important to choose a feasible path that can avoid the problem of hydrogen use.

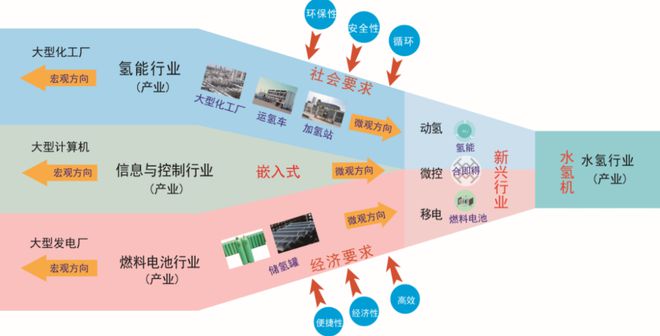

In the water hydrogen route, the methanol water reforming hydrogen production technology is highly integrated with the fuel cell power generation technology. The efficient intelligent control system realizes the immediate production and use of hydrogen, and provides reliable high-purity hydrogen for fuel cell power generation, ultimately achieving the goal of instant power generation. This path completely avoids a series of links such as compression, storage, and transportation of hydrogen during use. The hydrogen source is efficient, economical, and safe, providing a practical and feasible path for the development of fuel cell applications.

3、 The development trend of domestic hydrogen energy industry chain

In the fuel cell vehicle industry chain, the localization ratio of major components such as fuel cells will significantly increase in the next 5-10 years, and the price of fuel cell vehicles will continue to decline. Fuel cell vehicles currently have high costs, with the price of a fuel cell bus being 2-3 times that of gasoline vehicles of the same type. The main reason for the high price is the high cost of fuel cells and their core components, the fuel cell stack, which mainly relies on foreign technology.

With the improvement of domestic research and development capabilities, independently developed stack technology is gradually improving and maturing, and the proportion of localization will significantly decrease in the future.

On the other hand, the current shipment volume of fuel cells in China is still relatively small, but the production capacity of the layout has exceeded the demand by dozens of times. In 2019, the production of hydrogen fuel cell vehicles in China was only 3018 units, while the overall production capacity of fuel cells in China has reached 150000 units per year. Therefore, the fuel cell industry will face fierce market competition in the future, and prices will also decrease significantly.